stamp duty exemption for islamic financing 2018

The Stamp Duty Exemption No. Green Lane Policy Incentive.

Or a takaful operator licensed under the Islamic Financial Services Act 2013.

. Non-Resident Experts in Islamic finance. And for first time buyers. With the start of 2021 here are eleven 11 stamp duty exemption orders that have expired in year 2020These include stamp duty exemptions that have been valid since many.

Non- Resident Experts in Islamic finance. The Order provides a stamp duty exemption for the instrument of investment notes or Islamic investment notes for P2P financing executed by MSMEs or between MSMEs and. Including stamp duty exemption for instruments relating to non-ringgit Islamic finance activities executed under MIFC.

Stamp Duty Order Remittance Exemption - Tahun 2014. 5 2018 Amendment Order 2021 PUA 4622021. Stamp Duty Exemption No7 Order 2013.

There are different Stamp Duty Land Tax rates for residential homebuyers commercial property. RM300000 existing RM400000 additional. 0 - 57500.

One of the main principles of Islamic finance is that the. These reliefs can reduce the amount of tax you pay. The amount above 15 million.

You may be eligible for Stamp Duty Land Tax SDLT reliefs if youre buying your first home and in certain other situations. A all instrument of transfer executed in relation to the purchase of only one unit of residential property the value of which is more than three. Exemption on Micro Financing Scheme.

Budget 2019 has been carefully crafted to balance fiscal discipline and growth. 0 - No Limit. Full tax exemption on income earned from Islamic banking business or takaful business conducted through the International Currency Business Unit in foreign currencies by.

If the customer intends to move the loan the customer will incur a stamp duty for RM700000 ie. 5 Order 2018 was gazetted on 31 December 2018 to provide a stamp duty exemption on any insurance policies or takaful certificates for. Buying your first house with the price amounting to RM300.

Income tax exemption is granted for income received by. Me my wife plan to buy a property at BM Penang with price 435k on July19 she is a 1st-time buyer but not for me will entitle stamp. Year 2012 Stamp Duty Order Exemption PUA 108.

Loan agreement loan. The proposed Stamp Duty Amendment Bill 2018 also proposes stamp duty exemptions on instruments executed in land acquisitions for purposes of strategic investment. 12 The stamp duty exemption was granted in 2007 by Ministerial.

However moving it to an Islamic. The liability to pay Stamp Duty Land Tax or Land Transaction Tax is structured to mirror a conventional mortgage financed purchase so the appropriate tax will be payable on the first. The government commitment in addressing the need for.

Stamp Duty Exemption No. The term Islamic finance refers to financial transactions that are consistent with the principles of Islamic law Sharia. However stamp duty may be remitted in excess of 01 for the following instruments.

Stamp Duty Question Answer Client Question. Stamp Duty Scale for 2018 Now lets try explaining how you calculate stamp duty with a few scenarios. Property And Housing Summary.

Stamp duty of 05 on the value of the services loans.

Guide To Islamic Home Financing In Malaysia Propsocial

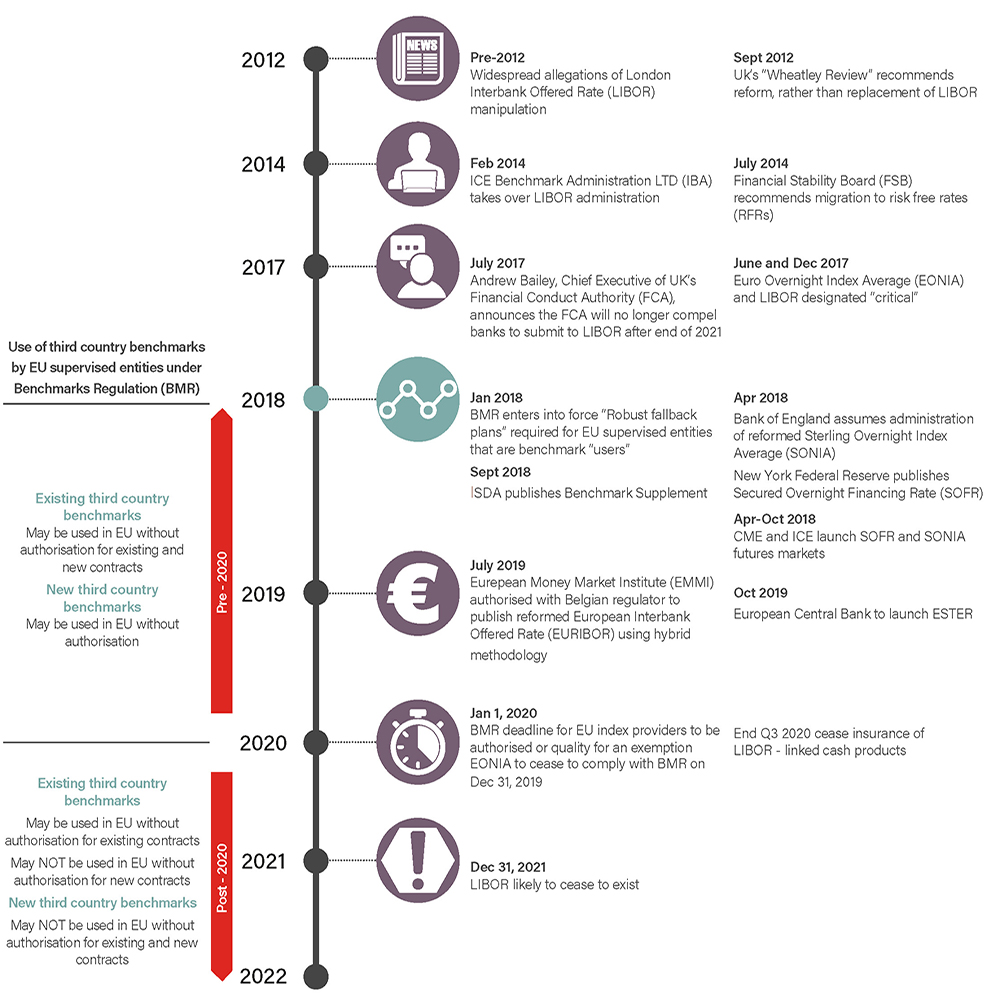

Benchmark Reform The Impact Of Ibor Transition On The Islamic Banking Industry Uganda Global Law Firm Norton Rose Fulbright

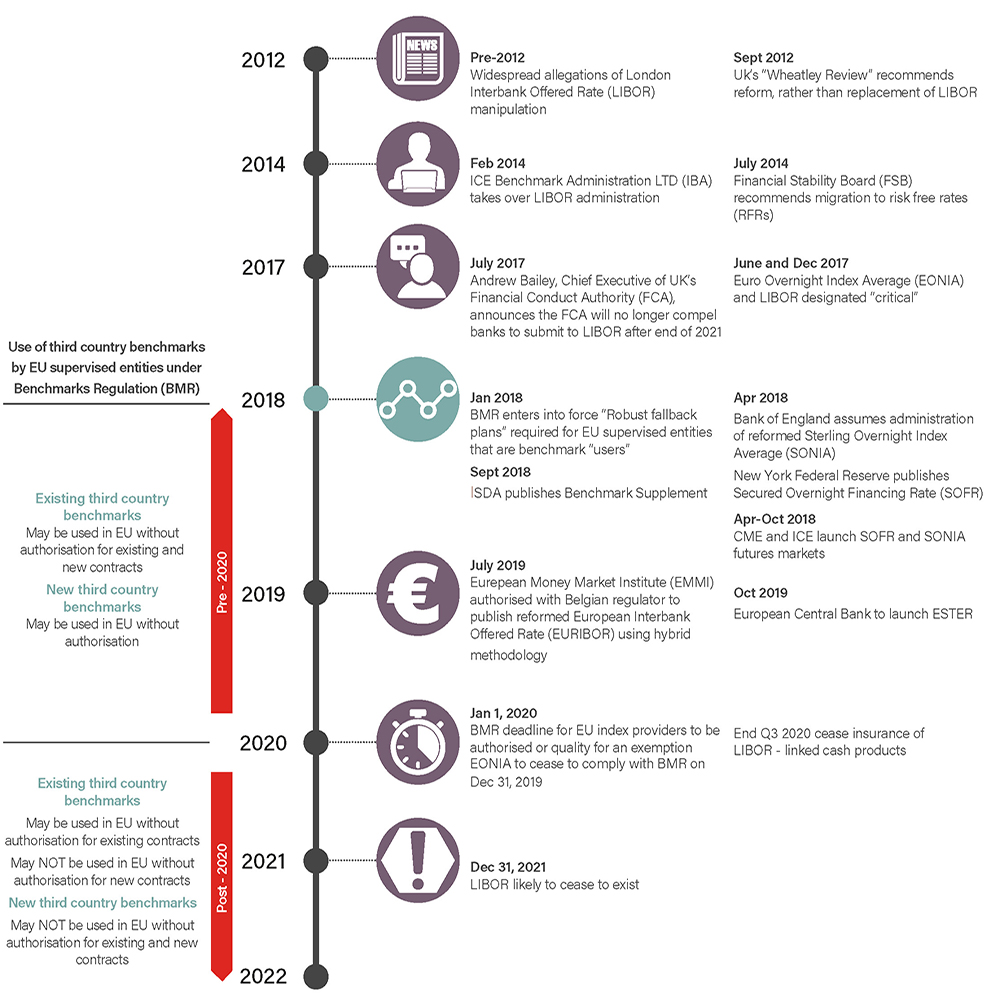

Pdf The Sharia Compliance Of Islamic Multi Contract In Islamic Banking

Guide To Islamic Home Financing In Malaysia Propsocial

Housing Development Updates Exemption Orders For Stamp Duty Chee Hoe Associates

Why Is Australia Reluctant To Accommodate Islamic Banking And Finance Abc Religion Ethics

Tax Treatment On Islamic Finance In Malaysia

Jrfm Free Full Text Shari Rsquo A Governance In Bahrain Analysing The Islamic Banking Industry Rsquo S Implementation Of The Newly Issued Regulatory Shari Rsquo A Governance Module Html

Bank Mellat Integrated Financial Statements March 2018 Islamicmarkets Com

Islamic Finance An Overview Sciencedirect Topics

Project Finance Laws And Regulations Report 2022 Hungary

Islamic Finance In The Post Soviet Central Asia And Transcaucasia The Evidence From Kyrgyzstan Emerald Insight

Jrfm Free Full Text Shari Rsquo A Governance In Bahrain Analysing The Islamic Banking Industry Rsquo S Implementation Of The Newly Issued Regulatory Shari Rsquo A Governance Module Html

Stamp Duty Exemption Malaysia 2019 Malaysia Housing Loan

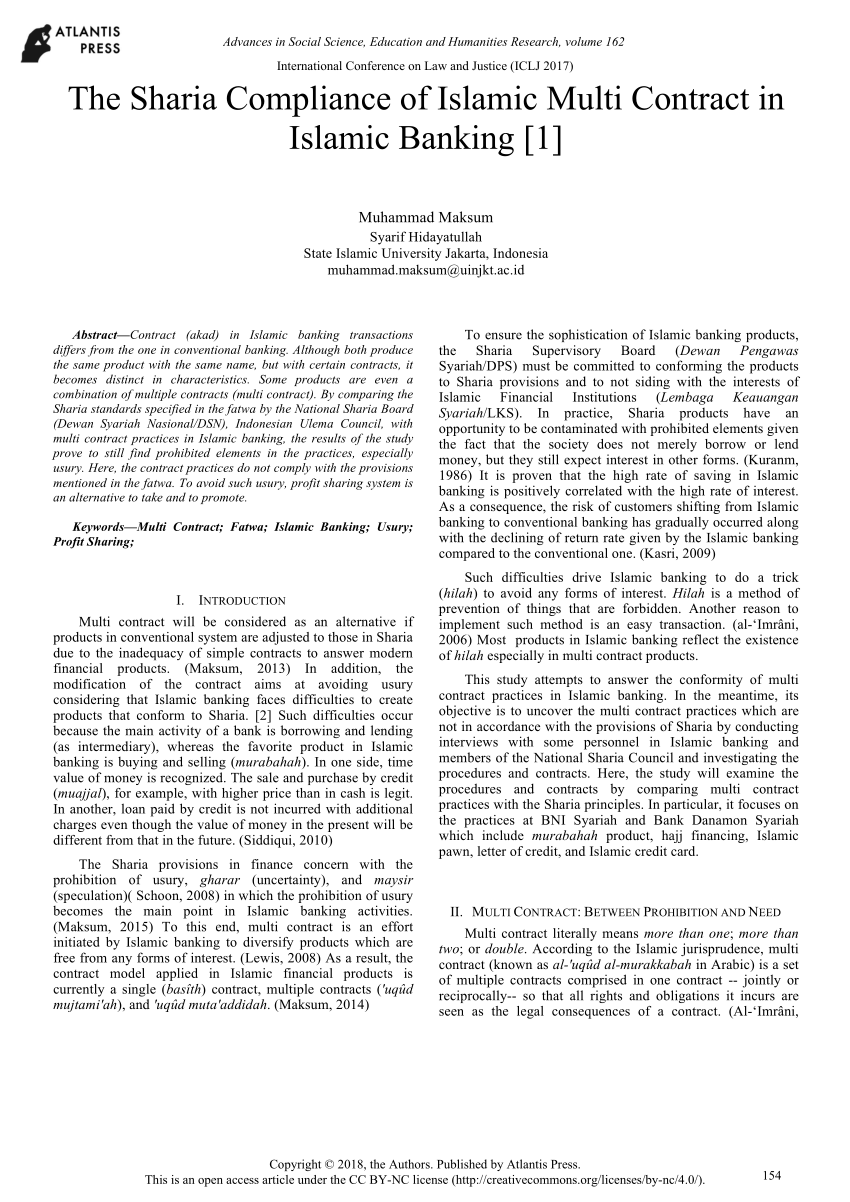

Financial Institutions Eligible For Stamp Duty Exemptions China Briefing News

Real Property Gains Tax Rpgt In Malaysia 2022

The Corporate Governance For Islamic Financial Institutions In Pakistan Need For Dynamic Regulatory Policies Emerald Insight

Comments

Post a Comment